Understanding MRR, MLR, and MOR Rates: The Key to Loan Interest Rates in Thailand

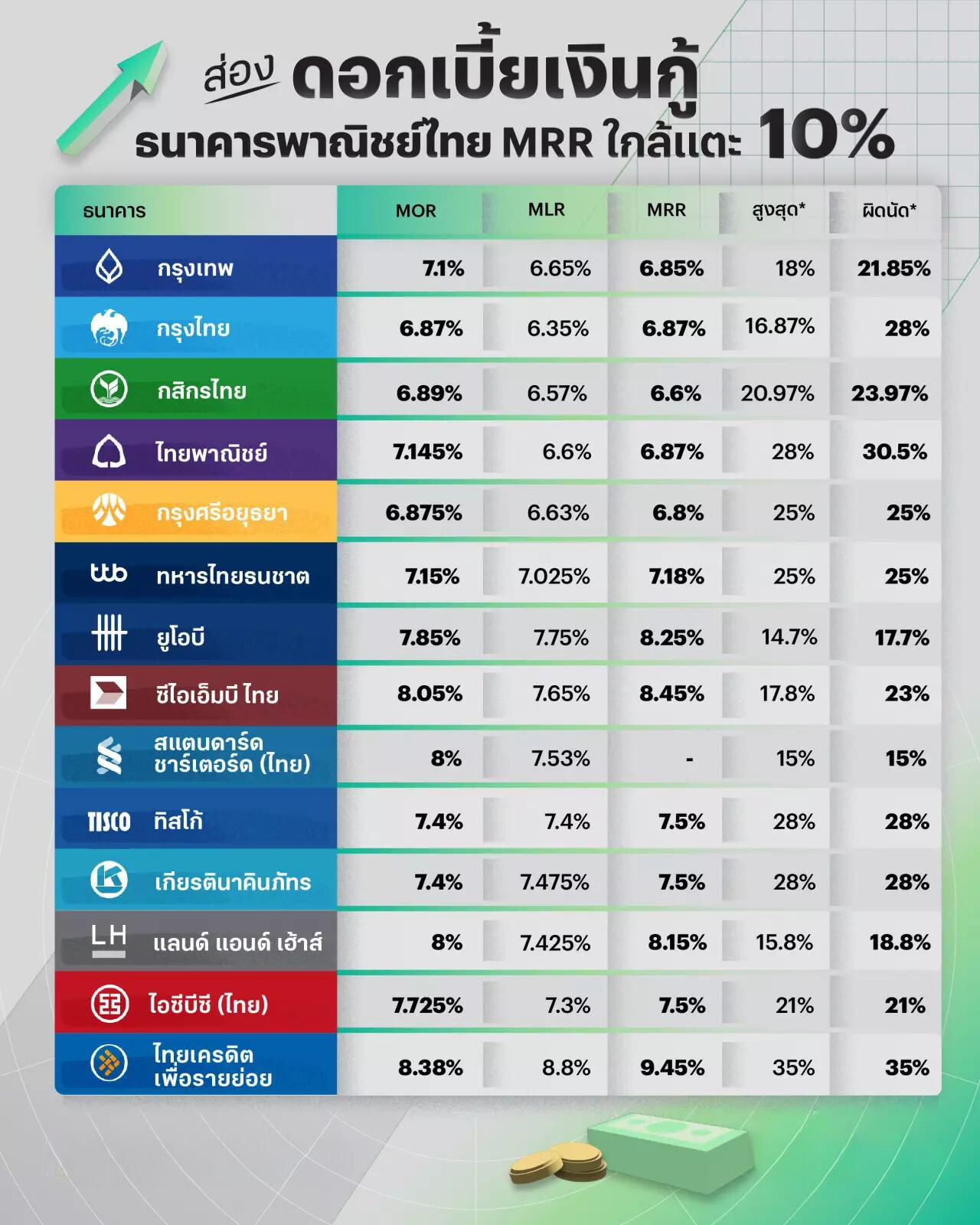

In Thailand, navigating the world of loans can feel overwhelming. One crucial factor to consider is the MRR MLR MOR Rate อัปเดตดอกเบี้ย (MRR MLR MOR Rate Interest Rate Update). These acronyms stand for Minimum Retail Rate (MRR), Minimum Loan Rate (MLR), and Minimum Overdraft Rate (MOR), and they significantly impact the interest rate you pay on your loan.

Demystifying MRR: The Benchmark for Retail Loans

The MRR MLR MOR Rate อัปเดตดอกเบี้ย (MRR MLR MOR Rate Interest Rate Update) starts with MRR. This is the MRR MLR MOR Rate อัปเดتดอกเบี้ย (MRR MLR MOR Rate Interest Rate Update) that banks use as a baseline for setting interest rates on loans offered to individual borrowers, like personal loans, auto loans, and mortgages. It’s essentially the minimum rate a bank can offer for these types of loans.

MRR MLR MOR Rate อัpเดตดอกเบี้ย (MRR MLR MOR Rate Interest Rate Update) is important because it gives you a starting point for comparing loan offers from different banks. However, it’s crucial to remember that the actual interest rate you receive will likely be higher than the MRR MLR MOR Rate อัปเดตดอกเบี้ย (MRR MLR MOR Rate Interest Rate Update). Banks can add a spread to the MRR based on your creditworthiness, loan amount, and loan term.

MLR: The Rate for Creditworthy Borrowers

The MRR MLR MOR Rate อัปเดตดอกเบี้ย (MRR MLR MOR Rate Interest Rate Update) also introduces MLR. This refers to the MRR MLR MOR Rate อัปเดตดอกเบี้ย (MRR MLR MOR Rate Interest Rate Update) offered to creditworthy borrowers for long-term loans, typically secured by collateral like property. Businesses and individuals with a strong financial history may qualify for an MLR that’s lower than the standard MRR MLR MOR Rate อัปเดตดอกเบี้ย (MRR MLR MOR Rate Interest Rate Update).

Understanding MRR MLR MOR Rate อัปเดตดอกเบี้ย (MRR MLR MOR Rate Interest Rate Update) and MLR empowers you to negotiate for a better interest rate on your loan. By presenting a strong credit score and financial profile, you can convince the bank you’re a low-risk borrower deserving of a rate closer to the MLR.

MOR: The Rate for Overdrafts

The final piece of the MRR MLR MOR Rate อัปเดตดอกเบี้ย (MRR MLR MOR Rate Interest Rate Update) puzzle is MOR. This applies to overdraft facilities on your bank account. If your spending exceeds your available balance, the bank will allow you to borrow additional funds, but this comes at a cost – the MRR MLR MOR Rate อัpเดตดอกเบี้ย (MRR MLR MOR Rate Interest Rate Update) or MOR.

MRR MLR MOR Rate อัปเดตดอกเบี้ย (MRR MLR MOR Rate Interest Rate Update) and MOR are typically higher than both MRR and MLR because overdrafts are considered a high-risk form of borrowing. It’s best to avoid relying on your overdraft facility unless absolutely necessary, as the interest charges can quickly add up.

Staying Informed: How to Find Updated MRR MLR MOR Rates

The MRR MLR MOR Rate อัปเดตดอกเบี้ย (MRR MLR MOR Rate Interest Rate Update) can fluctuate based on economic conditions. Banks are required to publish their updated MRR MLR MOR Rate อัปเดตดอกเบี้ย (MRR MLR MOR Rate Interest Rate Update) information regularly. You can find this information on the bank’s website or by directly contacting them.

Several financial websites and publications in Thailand also track and report the latest MRR MLR MOR Rate อัปเดตดอกเบี้ย (MRR MLR MOR Rate Interest Rate Update) information. By staying informed about these rates, you can make smarter financial decisions when applying for loans.

Conclusion: Utilize MRR MLR MOR Rates to Your Advantage

Understanding MRR MLR MOR Rate อัปเดตดอกเบี้ย (MRR MLR MOR Rate Interest Rate Update) is essential for navigating the loan landscape in Thailand. By familiarizing yourself with MRR, MLR, and MOR, you can:

- Compare loan offers from different banks and choose the one with the most competitive interest rate.

- Negotiate for a lower interest rate based on your credit

Condo Bangkok 2025 Prime Locations and Attractive Prices for Every Lifestyle

Condo Bangkok 2025: Prime Locations and Attractive Prices for Every Lifestyle Bangkok, the vibrant capital of Thailand, remains a top…

Investable Condominiums in Bangkok 2025

Investment-Worthy Condos in Bangkok 2025: Exploring Locations and Investment OpportunitiesInvesting in **investment-worthy condos in Bangkok** for 2025 is capturing the…

Who is Eligible for the ‘Baan Puer Kon Thai’ Project?

"Who is Eligible for the 'Baan Puer Kon Thai' Project?" The 'Baan Puer Kon Thai' project is a great initiative…

“Baan Puer Kon Thai” A Pathway to Homeownership

"Baan Puer Kon Thai": A Pathway to HomeownershipIntroductionThe "Baan Puer Kon Thai" project is a significant government initiative aimed at…

Home Decoration Ideas to Boost House Sales in 2025

Home Decoration Ideas to Boost House Sales in 2025 Selling a house can often be challenging, especially when owners rush…

Chinese New Year 2025

Celebrating the Lunar New Year 2025 Chinese New Year, also known as the Lunar New Year or Spring Festival, is…